Where To Get Mortgage Loans

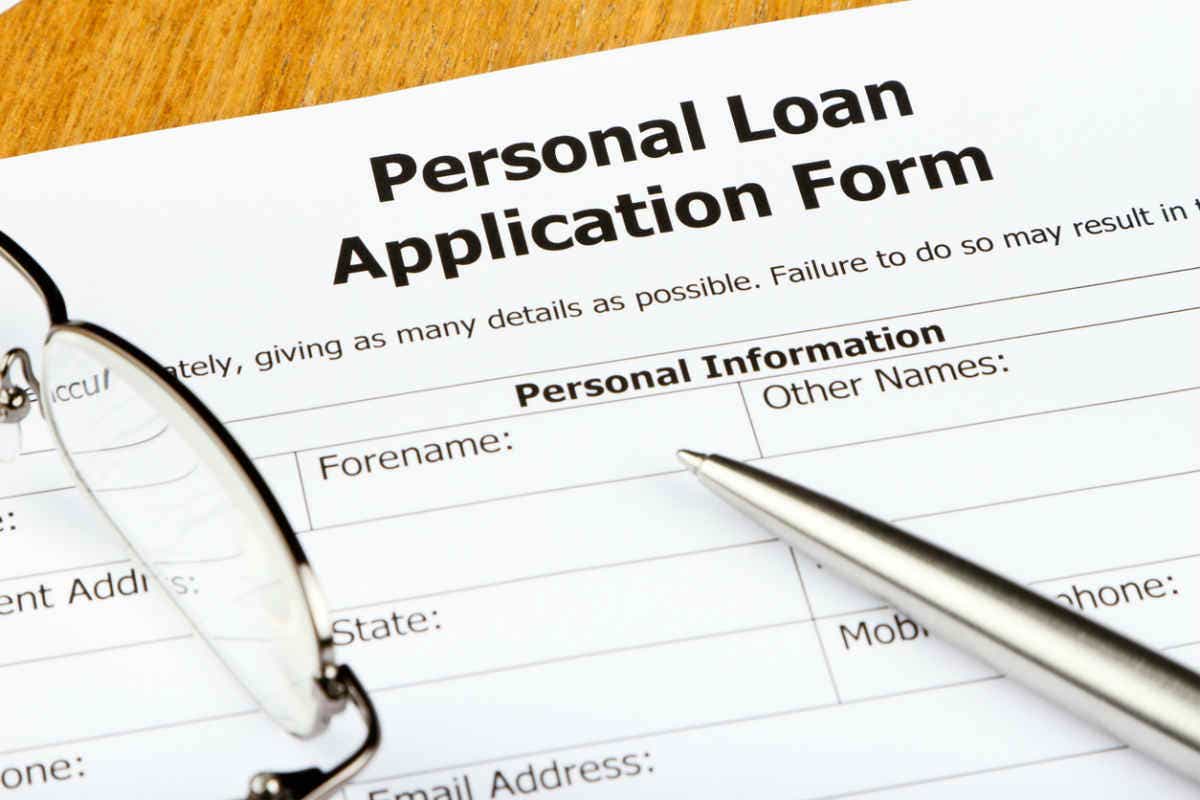

Probably like most home buyers, you will need to finance a portion of your home purchase, which you will need to obtain a mortgage loan. There are thousands of lenders to choose from and with hundreds of mortgage products that may or may not fit your circumstance.

Finding the best loan from a lender depends on your personal situation and the type of home you want to buy. Here are some lending sources available. If you visit the homepage of any online loan provider websites you can find ample of option and easy to get they approved. Even people with poor scores can also get the loan approved easily. There are many benefits of such website but make sure you pay them back or you can be in trouble,

Home Loan from Credit Unions

Credit union is a cooperative financial institution that is owned and controlled by its members, and operated for the purpose of promoting thrift, providing credit at reasonable rates, and providing other financial services to its members.

Credit unions might be your best option. Typically, credit unions provide superior service and being committed to helping members improve their financial health. Credit unions provide a broader range of loan and savings products at a much cheaper cost.

Credit unions differ from banks and other financial institutions in that the members who have accounts in the credit union are the owners of the credit union and they elect their board of directors in a democratic one-person-one-vote system regardless of the amount of money invested in the credit union.

Home Loan from Mortgage Brokers

Mortgage brokers act as an intermediary who sells mortgage loans on behalf of individuals or businesses. Traditionally, banks and other lending institutions have sold their own products. However as markets for mortgages have become more competitive, the role of the mortgage broker has become more popular. Mortgage brokers are the largest sellers of mortgage products for lenders.

Mortgage brokers can obtain loan approvals from the largest secondary wholesale market lenders in the country.

Mortgage brokers work with hundreds of lenders. It’s important to ask about the variety of mortgage products offered as this will vary between brokers. Broker fees are paid by the borrower or lender. Borrowers do not have to pay a fee if the loans at par. Yield-spread premiums are disclosed at closing and paid by the lender. Mortgage brokers can negotiate an up-front fee directly with borrowers in exchange for shopping for the lowest interest rate and fees.

Mortgage brokers work as a conduit between borrowers and lenders, loan officers typically works directly for lenders. Most states require the mortgage brokers to be licensed. A mortgage broker is normally registered with the state, and personally liable for fraud for the life of a loan.

Home Loan from Banks

Some examples of the big banks are JPMorgan Chase, Citibank, Bank of America, HSBC, and Wells Fargo. Your small community bank might be another option for cheaper loans and better customer service.

These banking institutions offer many financial products and services: savings and checking accounts, mortgages, personal loans, debit cards, credit cards, certificate of deposits, and so forth. Your bank may offer a discount on your home loan if you have deposits at that bank, a checking or savings account.

Home Loan from Online Lenders

Online banking or Internet banks allows customers to conduct financial transactions on a secure website operated by their retail or virtual bank, credit union or building society.

Features commonly unique to Internet banking include, personal financial management support, such as importing data into personal accounting software. Some online banking platforms support account aggregation to allow the customers to monitor all of their accounts in one place whether they are with their main bank or with other institutions.

HSBC Finance, ING Direct, and Ditech Mortgage are some of the online lenders.

FHA Loans

FHA loan is a federal assistance mortgage loan insured by the Federal Housing Administration. FHA loan may be issued by federally qualified lenders. FHA does not make loans. FHA insures loans made by private lenders.

The first step in obtaining an FHA loan is to contact several lenders or mortgage brokers and ask them if they originate FHA loans. You need to comparison shopping as each lender sets its own rates and terms.

FHA can help low and middle income families buy homes, by making it easier to obtain mortgage loans. One of the benefits of an FHA-insured loan is low mortgage rates. For single-family homes, down payments can be as low as 3%, making it possible to afford a home than with a conventional 10 to 20% down payment mortgage.

FHA can also help home buyers finance their closing costs, and even offers mortgage insurance. FHA does not allow lenders to charge more than one percent for origination fees. FHA loan has no prepayment penalty, meaning if you pay off the loan ahead of schedule, you won’t be penalized.