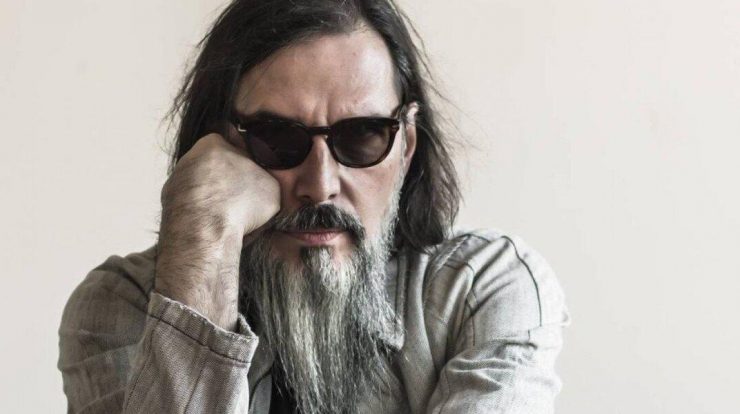

If you think you are “too old” (“too old”) for training - change your attitude. Date of birth and age are just a digit. There are hundreds of examples of people aged 60-70 years or more, with an activity greater than many in their forties. Indeed, there are examples of players who have veterans bodybuilding over 60 years, the silhouette can embarrass 20-year-olds! The problem begins when you tell yourself that it’s too late to sport. If you have already decided that it is time to change your life - it’s in the first place to do the medical examination. Athletes aged over 35 years are at risk when it comes to sudden cardiac death.

This does not mean that the risk of life, just make sure that you are healthy - especially if you smoke cigarettes, you are overweight, bad eating properly (including consuming alcohol), and had a family history of heart disease. Determine your blood pressure - at several different times of the day and also at home, to prevent the rise of blood pressure at the sight of the doctor (and due execution of the study). Then why not take an examination of the heart: Resting ECG and Exercise ECG. The sports clinic - you will pay for a set of such research to approx. 120 zł.

Resting ECG usually costs from 30 to 40 zł, exercise 75-90 zł. For free can perform a cardiac examination cardiologist after a referral from a family doctor (auscultation, ECG, if necessary, or irregularities as the so-called cardiac ultrasound. Echocardiogram). Unfortunately, the research for which they do not pay you to wait for several months.

Remember that some abnormalities are revealed only after intense physical effort, hence the ECG is more useful. The rest of the details will give you a doctor. It does not hurt also determines the level of total cholesterol, HDL and LDL, triglycerides. Liver function testing: ALT, AST, GGT (and other outsourced if necessary, according to doctor), complete blood count, urine. Again - a lot of research you can do for free, upon referral from your family doctor, or pay for their set.

“Do you work out after a 40-something makes sense, since the age of testosterone, growth hormone, muscle mass decreases?”.

YES! Strength training is also necessary to maintain efficiency in the subsequent years of life. If you think you have low testosterone examine testosterone levels of free and total (cost approx. 40 zł for one study, more useful as an indicator of free testosterone - ie. Unbound). Do not suggest too much the result, decreasing the amount of this hormone occurs with age, but quite slowly. The researchers suggest that between 30 and 50 years of age decrease the possibility of strength (maximum force) is negligible.

Attempts to deliver testosterone “outside” will make you have to provide a form of testosterone injections, pills, or patches (called. Hormone replacement therapy), which, unfortunately, has many side effects. In scientific studies, even men over 70 years, recorded the Filmaster strength and mass - the run strength training and aerobic. It was also found that only allows you to maintain regular workout results - already several weeks inaction goes back many hormonal changes caused by exercise. Admittedly, you can not go back the clock and another study to hormone response of men aged 30 and 62 years dispels illusions.

For example, after 10 weeks of strength training 30-year-olds and 62-year-olds increased their strength in the squat with a similar value of 15%, but muscle growth in the younger was much greater, respectively, 10.1 ± 3.7% and 5.9 ± 2.9% (for 30 and 62-year-olds ). It was also much higher performance strength (weight lifted in the squat for one rep.) In the group of younger players. Interestingly, the group of the rear thigh muscles (biceps femoris, semimembranosus, heel, etc..) - In 30-year-olds grew twice more during the observation. In the case of the quadriceps (front of thigh), there were no great differences between men. When it comes to the level of free and total testosterone in their thirties reported much higher levels of this hormone in response to strength training.

Worse, in a group of 62-year-olds throughout the 10 weeks of training there was no increase in free testosterone (and. Free testosterone). Conversely, the 30-year-olds increase in free testosterone was gradual over the next week’s training. When it comes to changes in IGF-1 between the two groups there was no difference, even in young people training did not cause ejection of growth hormone (comparing before and after strength training). Also, the amount of lactic acid in 30-year-old was significantly higher than in the group of 62-year-olds. Response to the stress caused by training was also negligible in the group of 62-year-olds.

Another study compared the response to training in a forty and siedemdziesięciolatków during the six months of exercise. In the group of 40-year-olds - there was an increase in strength of 27 +/- 9% in the 70-year-olds by 16 +/- 6% in straightening the legs while sitting. As you can see an increase in muscle strength is possible at any age. In another study showed no significant differences between the 40-year-olds and 70-year-olds - when it comes to increasing the static force and explosive.

Unfortunately, a comparison of people aged 19-35 with a group of 69-82 years has shown, among others, that the strength of the gastrocnemius muscle was twice lower in the elderly, and the maximum power of the muscle in young was five times! These studies show that the loss of strength with age is gradual, but power loss is much more serious and more violent. When it comes to the strength of the quadriceps another study showed that the maximum strength of the muscle groups in people aged 71-75 years is below 400 N and is about 47% lower than in the group of 30-35 years (on the basis of the development of their own and J. mountain “Physiology of exercise and physical training”).

“How to plan a workout after 40 years?”

Training - if you led a sedentary life, start with small changes in your life. Get on the bike, rather than sit in front of the TV. Go for a walk, instead of buying another beer. Limit your alcohol intake, stop smoking cigarettes. Stimulants significantly slow down your progress in training (including alcohol causes a decrease in the amount of testosterone). Remember that any additional traffic is for you wskazany- climbing stairs instead of the elevator you drive long walks, jog, marszo-running, running. The intensity will increase with the progress achieved. Rather than move anywhere by car, more walks. Running and marszo-racing perform in the field, away from city traffic. The exhaust will not make you healthier. Along with changes in physical activity, making elimination from the diet of bad products.

TRAINING PLAN:

Marches, walking, or running - 5-6 weeks 3-4 times a week after (30-40 minutes)

Running a moderate pace of 4-5 weeks 3-4x a week (25-40 minutes)

Slightly faster speeds - another week of training 3-4x a week (30-40 minutes)

Analogous to the marches and running you can start the adventure of swimming (moderate distances, slow tempo) or from riding a bike. Gradually going from the slowest to the fastest movement, on the occasion of losing body fat and improving run technique.

If you want to implement strength training - use a simple program for 3-4 days, based on free weights, to a lesser extent on the machine. Focus on basic exercises that build mass and strength, stamina reasonable - avoiding injury and overloading the joints. Undertaken physical activity will improve your mood, silhouette, and even let you enjoy better sex (blood flow, more testosterone through any natural testosterone booster).